Understanding The Function Of An Economic Consultant In Your Retired Life Planning

Web Content Created By-Cramer North

When it comes to your retirement preparation, the support of a monetary consultant can be instrumental in navigating the complicated landscape of economic choices. From establishing achievable economic objectives to crafting customized retired life strategies, their knowledge can make a considerable effect on securing your financial future. Recognizing the pivotal function a monetary expert plays fit your retirement can provide quality and instructions in accomplishing your long-lasting monetary purposes.

Benefits of Working With a Monetary Expert

When preparing for retirement, dealing with a financial advisor can offer you with very useful advice and knowledge. An economic advisor brings a riches of understanding to the table, helping you browse the intricate globe of retired life preparation easily. They can help you in establishing practical economic objectives, developing a customized retirement, and making informed investment choices customized to your requirements and risk resistance.

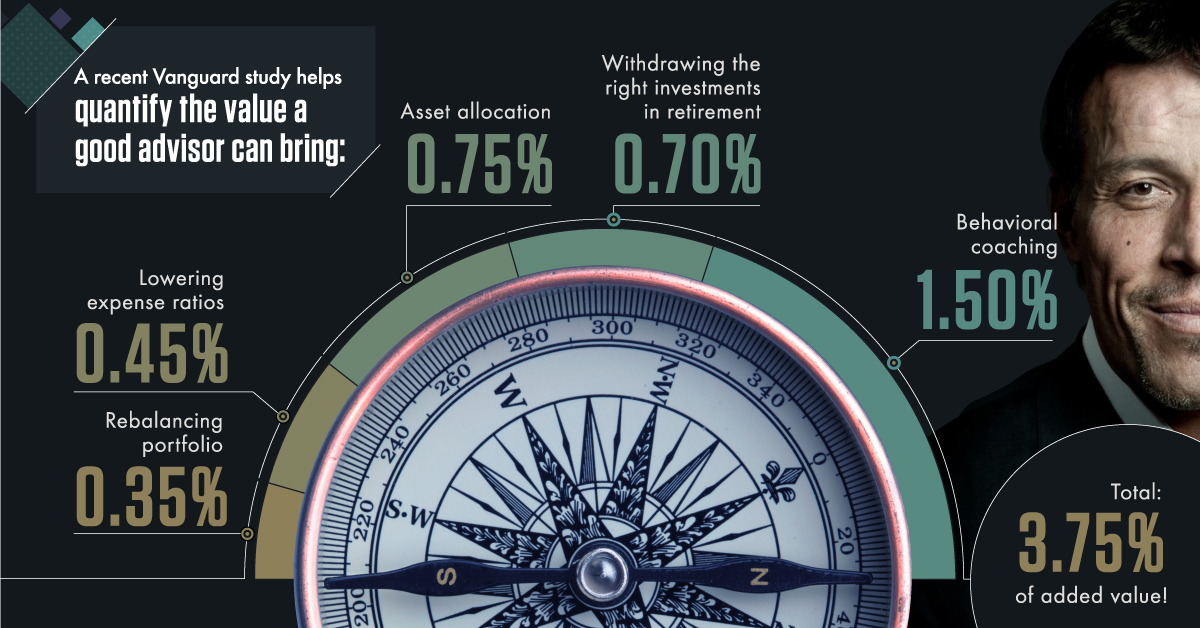

One of the essential benefits of dealing with an economic advisor is their capability to aid you optimize your retirement cost savings. By analyzing your existing economic scenario and future needs, they can create methods to maximize your financial savings possible and make sure a comfy retirement. In addition, monetary experts stay up-to-date with the most up to date market fads and financial investment possibilities, enabling you to make educated choices that line up with your lasting goals.

In addition, a monetary consultant can supply you with assurance by offering continuous assistance and peace of mind throughout your retired life trip. They can aid you change your monetary strategy as needed, attend to any problems or uncertainties you may have, and inevitably empower you to make certain monetary choices that lead the way for a secure and meeting retired life.

Solutions Used by Financial Advisors

Financial advisors use a range of solutions to help you in handling your funds and preparing for retired life successfully. These experts can assist you develop a customized financial plan customized to your particular objectives and needs. They offer assistance on investment techniques, property allowance, and risk monitoring to help you build a strong monetary structure for your retirement.

Additionally, economic consultants supply proficiency in tax preparation, assisting you maximize your tax situation and optimize your savings. They can additionally help with estate planning, making sure that your possessions are distributed according to your wishes. Retirement income planning is one more crucial service supplied by financial advisors, assisting you identify exactly how to produce a stable revenue during your retired life years.

Additionally, these experts supply recurring monitoring and modifications to your economic plan as needed, maintaining you on track to meet your retired life goals. By leveraging the solutions of a monetary expert, you can obtain peace of mind understanding that your monetary future is in qualified hands.

Just how to Pick the Right Financial Consultant

To locate the right monetary advisor for your retirement planning demands, consider examining their certifications and experience in the field. Search for consultants that hold appropriate qualifications like Certified Financial Coordinator (CFP) or Chartered Financial Professional (ChFC). https://www.nerdwallet.com/article/investing/what-is-wealth-management show a particular degree of competence and dedication to upholding market standards.

Furthermore, analyze the advisor's experience working with clients that remain in or near retired life. An expert who concentrates on retired life preparation will likely have a much deeper understanding of the unique obstacles and chances that feature this life stage.

When choosing a financial expert, it's also critical to consider their charge structure. Some advisors charge a flat charge, while others service a payment basis. See to it you understand how your advisor obtains made up to stay clear of any potential disputes of rate of interest.

Lastly, look for referrals from pals or relative that've had favorable experiences with their very own monetary consultants. mouse click the following internet site can supply important insights into an expert's communication design, dependability, and total effectiveness in helping clients reach their retired life goals.

Final thought

To conclude, dealing with a financial expert is critical for effective retired life preparation. Their expertise and assistance can help you establish realistic financial goals, develop tailored retirement, and make enlightened financial investment decisions tailored to your requirements.

By choosing the appropriate monetary advisor, you can considerably improve your retired life preparedness and financial wellness. Take the first step towards a safe retirement by looking for the aid of a trusted monetary expert today.